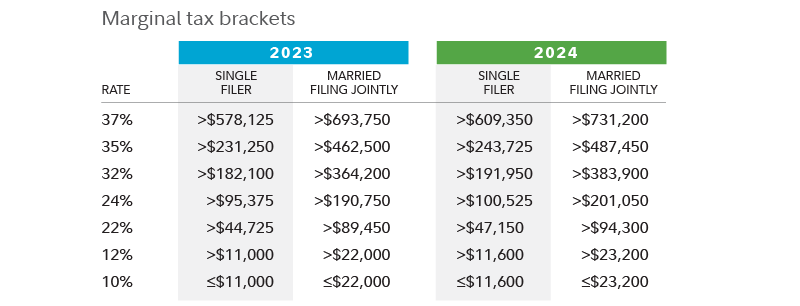

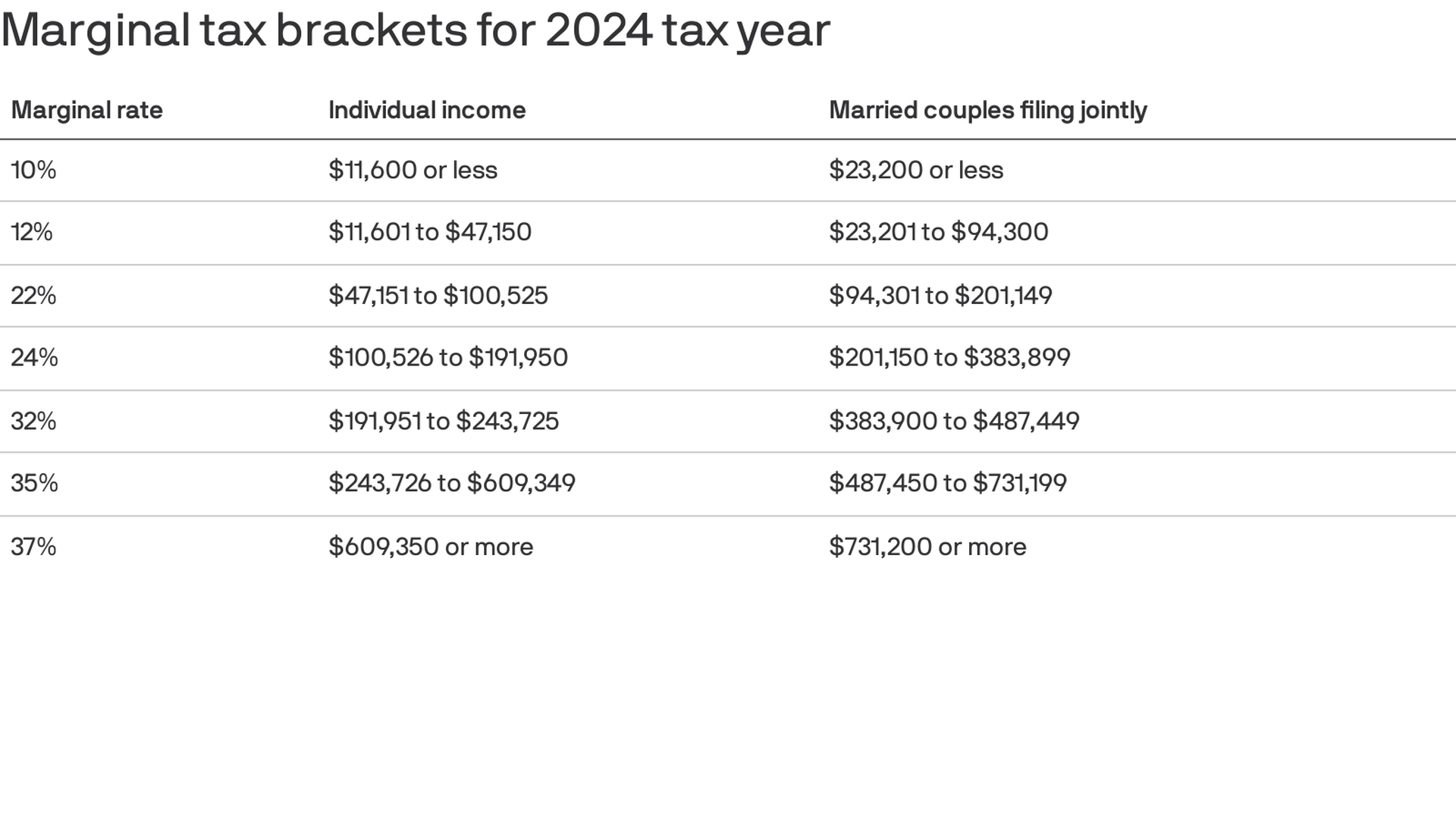

Tax Bracket Chart 2024 – For 2024, federal income tax brackets and the standard deduction are both increasing. This change is in response to sticky inflation, which has kept prices high all year. The higher amounts will apply . There are seven federal income tax rates for 2023 and 2024: 10%, 12%, 22%, 24%, 32%, 35% and 37%, depending on your taxable income and filing status. .

Tax Bracket Chart 2024

Source : www.forbes.com

IRS: Here are the new income tax brackets for 2024

Source : www.cnbc.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

IRS: Here are the new income tax brackets for 2024

Source : www.cnbc.com

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

Tax brackets 2024| Planning for tax cuts | Fidelity

Source : www.fidelity.com

2024 tax brackets: IRS inflation adjustments to boost paychecks

Source : www.axios.com

2024 Income Tax Brackets And The New Ideal Income Financial Samurai

Source : www.financialsamurai.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

Tax Bracket Chart 2024 Your First Look At 2024 Tax Rates: Projected Brackets, Standard : According to the tax brackets in the chart, your federal income tax can be calculated like this: 10% of the first $11,600, or $1,160. 12% of the amount greater than $11,600 but less than $47,150, . Every year, the Internal Revenue Service announces new tax brackets, tiers of income that are taxed at different rates under our nation’s progressive tax system. Each tier of income is taxed at a .